Why I Manage Stops Aggressively When Trading Precious Metals

I’ve been trading futures for 23 and in the early years I often complained of getting stopped out of trades. It’s incredibly frustrating to be stopped out of a trade only to watch the trade go the way you thought, but you are no longer on board. Many people will say the answer is to not use stops…. but if you are a futures trader that is ridiculous unless you spend the whole day monitoring the markets.

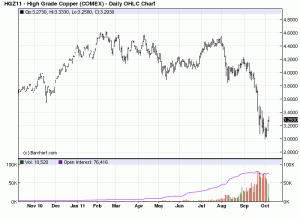

Here is a perfect example why. Silver broke above it’s 200 day simple moving average about a week ago. The market then set back slightly and for a short term trade I bought the futures at $35.45. The hard part about this trade was that we were quite a bit above the 10 day moving average which always makes me nervous. However when the market blasted higher yesterday I thought maybe I was worrying for nothing. Here is what the chart looked like at the end of the day:

In my early years of trading I would’ve simply been excited about a winning trade but it kept bothering me that realistically my stop had remain way down at about $33.65 in order to be safe. A $3.50+ stop might be fine if you are in a silver etf but not when you are in the futures, that’s ridiculous. So following my gut alone I exited the trade at $37.19 for a nice one day gain. I decided I was going to wait for a test of the 10 day moving average and if I missed the boat it wouldn’t bother me.

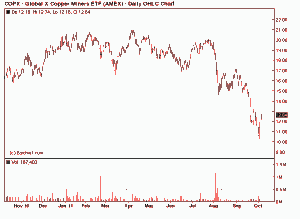

Well, the following day my gut instinct was validated when Bernanke made a few minor comments during a congressional testimony and it triggered a massive sell off in gold and silver. Here is the hourly chart of silver following the comments.

As you can see anything above $33.50 would’ve been stopped out and I probably would’ve been stopped out at the low of the day. Now the question is whether or not it was the right move to get out based on my gut? It’s not what I normally do but over the years I’ve learned to always follow my gut.

What I normally do is move my stop up to break even after a big move like yesterday. Then each day I wait for the morning lows to be made and then I move the stop up. Alternatively, if the market the market is getting over heated I normally get out at the end of the day like I did yesterday. With all the leveraged ETFs in the market that need to reset their position at the end of the day the markets seem to close frequently on the high or low. So it’s the best time of the day to exit a trade.

By the way, silver wasn’t alone in the sell off today. Gold actually broke down worse (chartwise) than silver. I’m going to simply sit back and let the dust settle…. enjoying my cash position!

The moral of this story is that if you are trading futures on a short term basis like I do, it’s important to continuously protect gains by aggressively moving stops up or down. Metals tend to move fast and hard so when they do you want to “lock in” your gains and protect against big losses. The only ways to do this is to remain glued to your screen or use stops. For me…. stops are the only way to go!