Rule #1 – Beware Of Asset Bubbles!

Let’s begin by talking about bubbles. Not the kind you blew as a kid with soap or bubble gum, but asset or investment bubbles.

When you survey the retirement landscape, it’s easy to see why so many people are confused by how to properly plan for the future. After the decade long roller coaster in the stock market, most people have given up on the idea of retiring based on their stock market portfolio. This compares to 11 years ago when many investors and day traders were polishing up their golf clubs and quiting their day jobs.

As the Tech Bubble imploded and stock indices plunged to multi-year lows the federal reserve lead by Alan Greenspan pushed interest rates to 30 year lows and held them there for an extended period of time. At the same time banking regulations were relaxed and this combination lead to a once in a lifetime Housing Boom. Suddenly there were millions of landlords who were going to retire on their real estate holdings, after all real estate never goes down right? Well, maybe not.

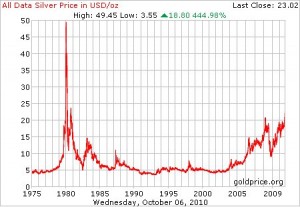

After the most vicious real estate bear market since the great depression which resulted in a “near collapse” of the entire banking system, it seems there are few investors interested in real estate anymore. What’s the hot idea now? Gold, silver, palladium…. basically anything shiny! It seems we’ve turned the clock back to the 1970’s and the big rage is anything that hurts when you drop it on your foot.

The incredible growth of ETFs has made it possible for almost anyone to invest in almost anything. So with Ben Bernanke supercharging the approach used by Alan Greenspan and adding almost endless liquidity to the markets there are bound to be many more asset bubbles in our future.

Why are asset bubbles important to you? They are important in two ways:

#1 – Knowing a bubble is brewing can help you make some decent stock selections based on who profits from the impending bubble.

#2 – Knowing that all bubble’s eventually pop and most fall nearly all the way back to where they originally began helps you avoid being the “sucker”.

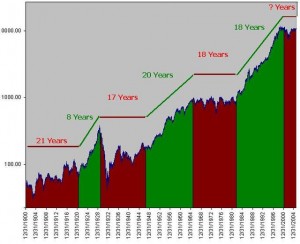

How long did it take investors in the Dow Jones Industrial Average at the peak in 1929 to get their money back? Without adjusting for inflation it took about 25 years (1954). If you look at the 70’s on this chart it looks very similar to where we are today. (click picture to enlarge)

How long did it take Gold investors who bought at the high in 1980 to get their money back? Nearly 28 years and that’s without adjusting for inflation. With inflation adjustments they still are a long ways under water as are those who invested in silver at the peak.

Will people who bought Yahoo stock at the peak ever get their money back?

How about those who bought the peak in the Miami Condo market?

The first thing we want to do when investing for retirement is to avoid making huge mistakes and the biggest mistake most people make is investing at or near the top of an asset bubble.